THE EXPERT'S VIEW

The definition of a machine tool, according to the Spanish Association of Machine Tool Manufacturers (AFM), covers a broad variety of machines with a common denominator: they are all designed to manufacture products or product components, generally, but not exclusively, of metal. Machine tools are regarded as “parent” machines because they enable all the other machines to be manufactured, including themselves.

There are many types of machine tools, ranging from simple lathes to complex machining centres; from machines that manufacture components of less than a fraction of a millimetre to machines that produce parts several dozen metres in size.

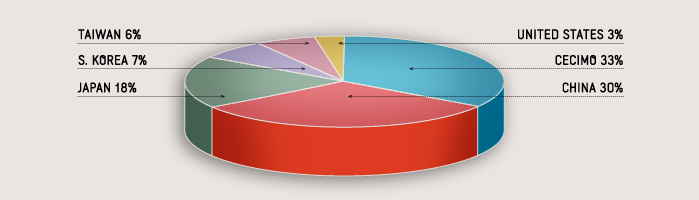

The global market share of European manufacturers is clearly in decline. In 2011, it had 30% which was worth about 20,000 million euros, according to the Association of European Machine Tool Industries (CECIMO).

Distribution of the machine tool market worldwide (source CECIMO)

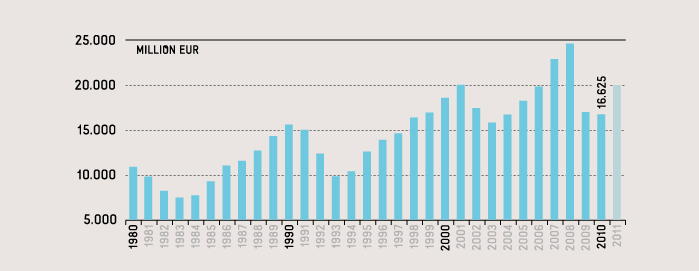

Evolution in European machine tool sales (source CECIMO)

As the above graph shows, the sector suffered a dramatic slump in 2009 and 2010 compared with the previous excellent years. 2011 and this year 2012 have seen a slight improvement.

In the Spanish market the situation is even more dramatic than that of Europe as a whole. To the international crisis has to be added the even more pronounced shrinking of the internal market. The percentage of exports of Spanish machine tool manufacturers, already very high because it constitutes 80% of its production, must be increased to make survival viable.

Right now, there has been a clear shift in the manufacture and consumption of machine tools towards Asian countries. China is already the largest producer of machine tools, and naturally the biggest consumer.

On a recent mission organised by the AFM to China, we saw that the label "cheap and nasty Chinese machine" is an illusion. The means of production seen and the machines produced are on a good level. It is what has recently been described as "good enough", i.e. having sufficient quality. They are machines designed mainly for the domestic market with a medium-range technical level and very competitive prices.

European manufacturers cannot compete with these manufacturers in terms of price. In recent years, Spanish manufacturers have sought opportunities in large-sized machines (increasingly larger ones), driven by emerging sectors (energy, aeronautics, off-shore, etc.) that need to machine increasingly larger components. They are machines produced singly, and Asian manufacturers have not gained access to them because they are channelling their efforts towards mass-produced machines.

Unfortunately, more and more Asian manufacturers (Korea, China, etc.) are starting to appear on the scene with the capacity to produce large machines, although at the moment they only supply the Chinese market.

Traditional markets are increasingly demanding machines with greater productivity, greater precision and shorter delivery dates. And the biggest competitors are cutting-edge manufacturers like Germany Japan or Switzerland that offer machines with very advanced technology known as smart machines..

The promotion of machine intelligence has to be one of the solutions to enable Spanish manufacturers to maintain their current market share. In this line a project has been submitted for the Etorgai 2012 “Imaghine” call, led by Goratu, with the participation of the most important machine-tool manufacturers and with the technical leadership of IK4-TEKNIKER and IK4-IDEKO. These two R+D centres have proven experience in the sector and are fully recognised.

Specifically, IK4-TEKNIKER has had a team of people working in this ambit for over 25 years. In 2011, 24 different companies in this sector were provided with services, with a turnover from industrial projects in excess of 3 million euros.

The offer provided by IK4-TEKNIKER to this sector is broad, but it can be fitted into the following four groups:

- Machine tool design and manufacturing

- Calculation and advanced simulation

- Calculation and kinematic, static, dynamic and thermal simulationo

- Multibody simulation

- Regulation and control

- Dynamic testing and dimensional metrology

Finally, to demonstrate the firm, constant commitment of IK4-TEKNIKER to this sector, we can highlight the following features of this R+D centre:

- Over 25 years’ experience at the service of machine tools.

- Proven recognition in the sector.

- Participant in flagship machine tool projects: Cenit eEe, Next, Etorgai Hiperion, Impeler, Eumecha, Teams, Mantys, etc.

- Members of the technology committee of the machine tool cluster, and of the organising committee of the machine tool congress.

- Participant in AFM missions to Japan, Korea, USA, China etc.

- Participant in the Spanish Capital Goods Observatory.

- Close collaboration with AFM/INVEMA (Foundation for Machine Tool Research).

- Pioneers in many machine tool developments nationally: first milling machine with linear motors, first ultra-precision milling machine, first motor-driven injector machine, parallel kinematic machine with five degrees of freedom, first manufacturer of magnetic drive systems, etc.